Car insurance has changed as of January 1, 2025, and pricing will now be differentiated. All drivers who have caused accidents will face higher insurance premiums. In determining the insurance price, factors such as the age of the vehicle and the driver’s experience will also be taken into account. The regulation states that the insurance company itself may apply additional risk factors beyond those explicitly предусмотрed.

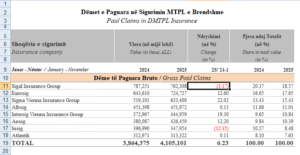

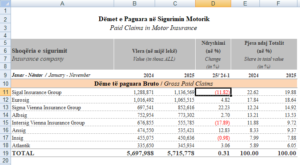

However, while car insurance premiums are expected to increase based on accident history, an unusual phenomenon has occurred at some motor insurance companies. Gross written premiums for insurance for the period January–November 2025 reached 24,254 million lekë, or 10.17% more than in January–November 2024. During January–November 2025, the number of insurance contracts concluded reached 1,506,529, an increase of 4.69% compared to the same period a year earlier. Claims payments during January–November 2025 fell by 3.61% compared to January–November 2024. The largest share of gross claims paid belongs to motor insurance, at around 5,715 million lekë, or 76.33% of total gross claims paid.

At SIGAL, the company led by Avni Ponari, it is noted that during the January–November period there was a 12.5% increase in Gross Written Premiums for motor vehicles, meaning the company collected higher revenues. However, when it comes to compensation payments, for 12 consecutive months SIGAL has reduced payouts for accident-related claims. This decrease, according to the official report published by the Financial Supervisory Authority (AMF), amounts to nearly 12% less compared to the same period a year earlier, despite the increase in profit from Gross Premiums. Meanwhile, SIGAL has also recorded a decline in compensation payments for the Green Card insurance, which is required by citizens traveling abroad to be covered by insurance.